The concept of compounding is a financial wonder that has the potential to transform your wealth over time. It is a phenomenon where your money grows exponentially by reinvesting the returns it generates. The longer you stay invested, the greater the impact of compounding. In this article, we will delve into the mechanics of compounding, explore its remarkable benefits, and provide real-life examples to illustrate its power.

Understanding Compounding

Compounding is essentially earning returns not just on your initial investment but also on the accumulated interest or gains generated over time. This compounding effect snowballs your wealth, allowing it to grow at an accelerating rate. The key components of compounding are

- Time

- The rate of return

- Reinvestment

Let’s say you invest ₹10,000 with an annual interest rate of 8%. At the end of the first year, you earn ₹800 in interest, bringing your total investment to ₹10,800. In the second year, you not only earn 8% on your initial ₹10,000 but also on the additional ₹800, resulting in a higher interest of ₹864. This process continues, and as time passes, the compounding effect becomes more pronounced.

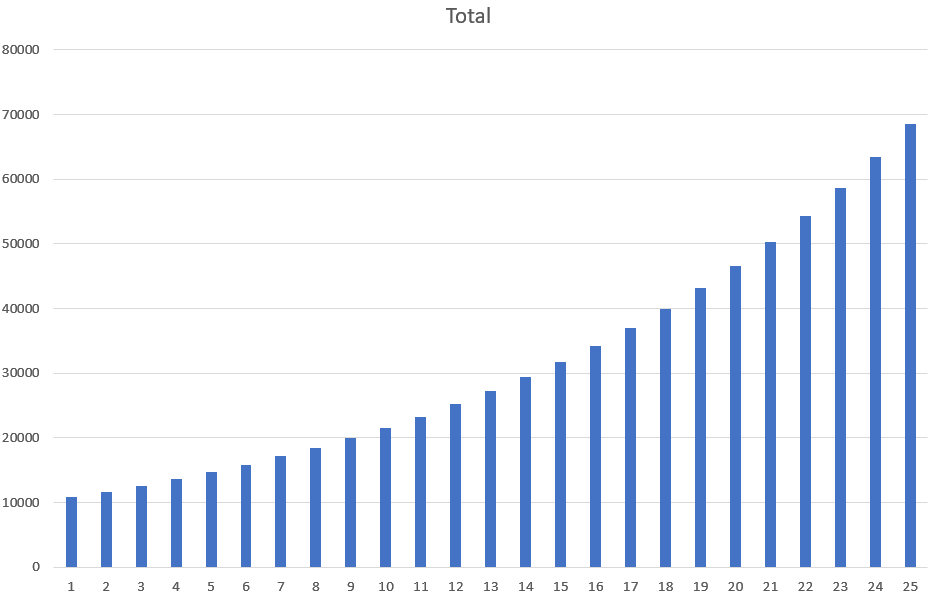

The below table and chart show how an initial principal amount of ₹10,000 grows by 7 times in 25 years!

| Year | Principal | Interest | Total |

| 1 | 10000 | 800 | 10800 |

| 2 | 10800 | 864 | 11664 |

| 3 | 11664 | 933 | 12597 |

| 4 | 12597 | 1008 | 13605 |

| 5 | 13605 | 1088 | 14693 |

| 6 | 14693 | 1175 | 15869 |

| 7 | 15869 | 1269 | 17138 |

| 8 | 17138 | 1371 | 18509 |

| 9 | 18509 | 1481 | 19990 |

| 10 | 19990 | 1599 | 21589 |

| 11 | 21589 | 1727 | 23316 |

| 12 | 23316 | 1865 | 25182 |

| 13 | 25182 | 2015 | 27196 |

| 14 | 27196 | 2176 | 29372 |

| 15 | 29372 | 2350 | 31722 |

| 16 | 31722 | 2538 | 34259 |

| 17 | 34259 | 2741 | 37000 |

| 18 | 37000 | 2960 | 39960 |

| 19 | 39960 | 3197 | 43157 |

| 20 | 43157 | 3453 | 46610 |

| 21 | 46610 | 3729 | 50338 |

| 22 | 50338 | 4027 | 54365 |

| 23 | 54365 | 4349 | 58715 |

| 24 | 58715 | 4697 | 63412 |

| 25 | 63412 | 5073 | 68485 |

The Power of Time

Time plays a crucial role in the power of compounding. The longer your money remains invested, the more time it has to compound and grow. Even small contributions made early can have a significant impact on your wealth due to the extended time horizon.

Consider two individuals, Anika and Raj. Anika starts investing ₹1,000 per month at the age of 25 and continues until she is 35. Raj, on the other hand, starts investing the same amount but waits until he is 35, investing until he is 65.

Assuming an average annual return of 7%, at the age of 65, Anika will have accumulated approximately ₹1.2 Crore, while Raj will have around ₹68.5 lakhs. The difference in wealth is a testament to the power of starting early and harnessing the full potential of compounding.

Real-Life Example

To further illustrate the wonder of compounding, let’s look at a real-life example:

Rakesh Jhunjhunwala: Rakesh Jhunjhunwala, a renowned Indian investor, was a strong advocate of compounding. He started investing at an early age and allowed his wealth to compound over several decades. The majority of his massive net worth, estimated in the billions of rupees, is the result of compounding his investments in various companies.